(This is a complex and long-brewing issue between the world’s two largest superpowers. If there was an easy way to fix it, it would have already been done. This is meant to be a primer for those who don’t feel they understand what they’re hearing on the news…)

For most of the last year, media headlines have been dominated by the ongoing US/ China trade war. The on-again, off-again trade negotiations between the two superpowers have created a nervous anxiety that has weighed down stock markets globally.

To understand what exactly is going on, why it’s occurring, and more importantly, what impact it will have on me, let’s break the situation into its component parts:

What, exactly, is a trade deficit?

A trade deficit simply means Party A is spending more money with Party B than Party B is spending with Party A. Because they are not spending the same amount as each other, one Party ‘runs a trade deficit’ while the other ‘runs a trade surplus’. The surplus or deficit itself is neither good nor bad. It simply represents the imbalance between the two.

Forget trade deficits between two countries for a just minute, let’s bring this back to a personal level and make it even easier: I routinely run a trade deficit with Costco[1]. I buy way more of Costco’s retail goods each year than they buy of my financial services. But it’s not just Costco. Turns out I routinely run trade deficits with all the local gas stations, grocery stores, and restaurants around town. Day after day, year after year, I spend way more on their goods and services than they spend on mine. And yet, neither me, nor my wife, nor Costco have any issue with this.

Why? Because while I’m busy running these trade deficits with Costco and Exxon and Chili’s, I am simultaneously running a trade surplus with my employer, Sanctuary Wealth Management. Sanctuary is buying way more of my goods and services every year than I’m buying of theirs. Furthermore, because the combinedtotal of all my trade deficits with Costco, Exxon, Chili’s, etc. is less than my trade surplus with Sanctuary each year, I actually have some left money over to save and invest for the future. The goal of these extra invested funds is to one day provide the funds needed to cover my ongoing trade deficits with Costco and Exxon and Chili’s when I no longer run a trade surplus with my employer (i.e. retirement).

Then what’s the issue with the US and China?

Here are the final 2018 numbers for our surplus/deficit with China:

![]()

Source: Office of United States Trade Representative

The issue with these numbers is part economic, part political.

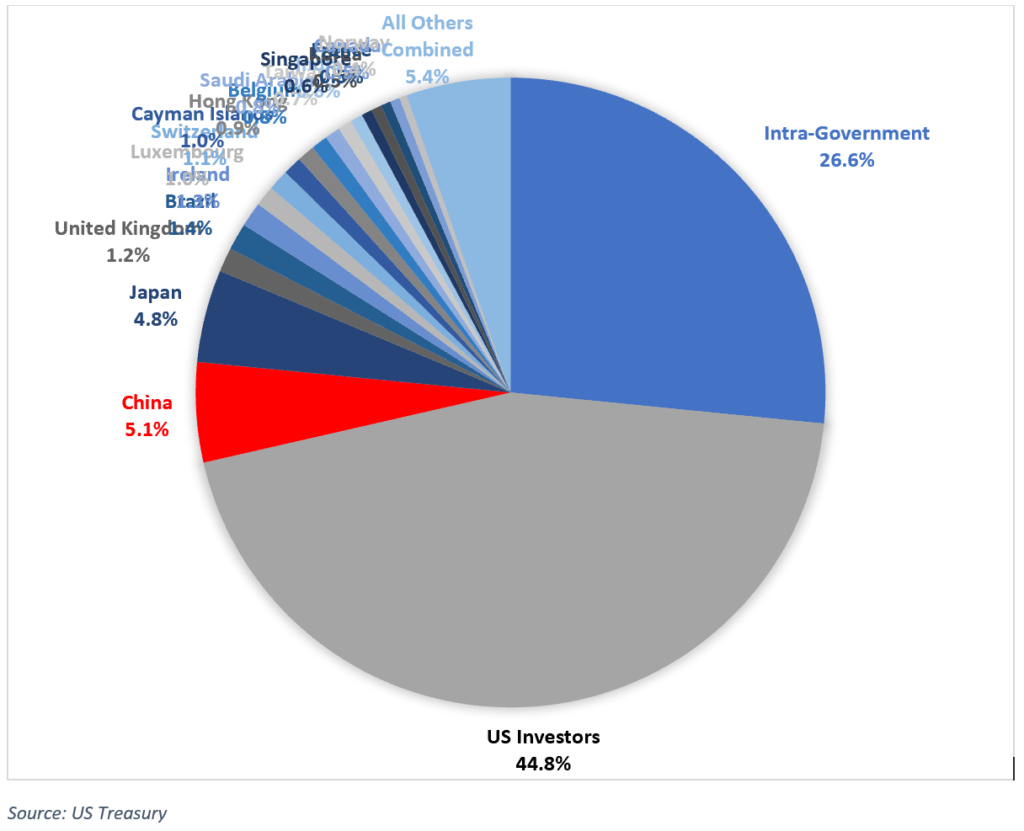

First, the economic part. Unlike my example above where my personal trade surplus each year is greater than my collective trade deficits – which creates extra funds to invest (like buying stock in Costco and Exxon) – the US has not had a net trade surplus since 1981. In other words, we buy more stuff from neighboring nations each year than they buy of ours. We have no funds leftover to invest. To make up for this shortfall, we routinely have to borrow from our neighboring nations. We issue bonds denominated in US Dollars, and our neighboring nations quickly snatch them up. Here is who holds our current debt:

As you can see, China – our supposed trade ‘enemy’ – is also our nation’s largest external lender.

But the bigger issue in this trade war is the political one: the US has long since accused China of stealing our intellectual property to their unfair advantage.

How much is this theft costing us? Guesstimates range from $225 billion to $600 billion of stolen IP annually. To put this in perspective, our nation’s largest gold deposit – Fort Knox – holds about $190 billion of gold on any given day. In other words, China is stealing 2 or 3 Fort Knox’s from us every single year. Wait, what?

Now you can see why some politicians are angry. If someone were to attempt to steal our Fort Knox, we would probably come after them guns-a-blazin’. But stealing a Fort Knox (or two or three) of intellectual property each year? No big deal – most previous US Presidents have largely looked the other way to avoid ruffling international feathers.

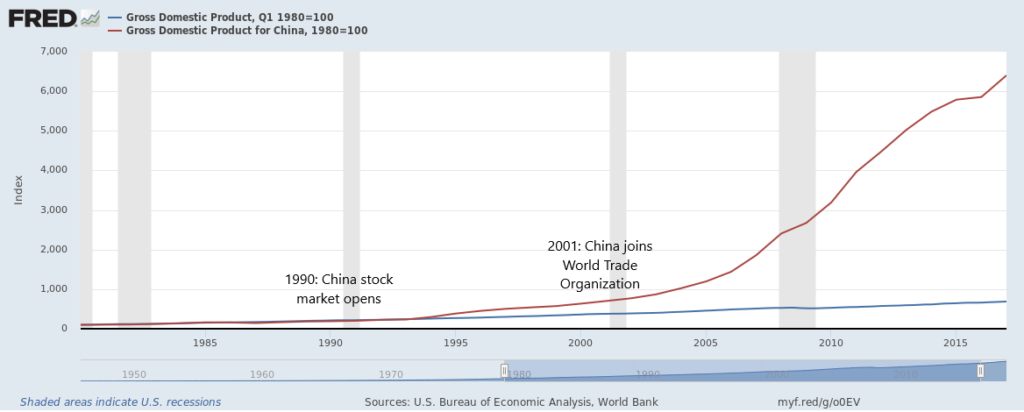

Stealing that many Fort Knox’s every year has helped China tremendously. Ever since China reopened their stock market in December 1990 (closed in 1949 after the Communist revolution) and was admitted to the World Trade Organization in 2001, their economy has soared. This chart shows US GDP vs China GDP since 1980 if I index them both to a base level of 100 in 1980:

So just how is China stealing all this intellectual property?

The traditional methods of espionage and hacking are certainly in place, but there’s an even easier way. In order to do business in China, the Chinese government requires most foreign firms (including US companies) to joint-venture with a Chinese firm in order to gain access to China’s low-cost manufacturing system or vast population markets, even though this is explicitly prohibited under WTO agreements. In doing so, the US company ends up begrudgingly sharing with the Chinese company critical intellectual property secrets (patented designs, trade secrets, computer code, etc.) traditionally protected under both US intellectual property law and WTO agreements.

Once the ‘partner’ Chinese firm has access to the intellectual property, it mysteriously gets used elsewhere and a short time later, copycat products begin showing up in the marketplace, severely undercutting the original proprietor of the intellectual property.

But it’s more than just stealing the computer code to the latest Candy Crush iPhone app. China has been caught with illegally obtained IP from the F-117, F-22, F-35, C-17, artificial intelligence, turbofans, missile defense systems, the data facilities of almost every major US defense contractor, and our US MQ-1 Predator Drone:

US Predator:

Chinese Wing Loong (Pterodactyl):

(or see China’s clone of our F-35)

Former Director of the National Security Agency Keith B. Alexander called Chinese industrial espionage “the greatest transfer of wealth in history.” In an August 2017 op-ed for the New York Times, Alexander said:

“Chinese spies have gone after private defense contractors and subcontractors, national laboratories, public research universities, think tanks and the American government itself. Chinese agents have gone after the United States’ most significant weapons, such as the F-35 Lightning, the Aegis Combat System and the Patriot missile system; illegally exported unmanned underwater vehicles and thermal-imaging cameras; and stolen documents related to the B-52 bomber, the Delta IV rocket, the F-15 fighter and even the Space Shuttle…”

Now you can see why this is such a big deal. It would be one thing if China was developing their own technology, bringing it to market, and their economic power was soaring because of it. But when the technology is invented and developed in the US, but then copied/cloned/stolen by China to their economic benefit, it’s an entirely different matter.

So what is the US doing about it?

The US has repeatedly asked the WTO to step in. The WTO has been reluctant to do so. The US has gone so far as to propose evicting China from the WTO (didn’t go anywhere). Hence, the US is taking direct aim at where it always hurts the most: the pocketbook.

In January of 2018, President Trump began increasing tariffs on all sorts of products coming into the US: solar panels, steel, aluminum, washing machines, aircraft parts, batteries, TVs, medical devices and a host of other categories. Some were only 10% tariffs, while others were 25-30%.

A tariff is simply a penalizing tax. It’s an import tax meant to make the imported product more expensive to the customer, which will in turn decrease demand of the imported product. If I as a consumer am trying to choose between two similar TVs for example, and then overnight one of them suddenly becomes 30% more expensive because of a recently enacted tariff, I’m probably going to go with the less-expensive, non-tariff TV.

The thinking behind the current round of tariffs is that if the US tariffs can reduce demand for Chinese products enough to cause economic pain, China may be willing to agree to improved trade terms and intellectual property rights.

China responded by implementing their own tariffs on the goods we export to them such as airplanes, pork, soybeans, and many other agricultural products. This tit-for-tat tariff implementation has been going back and forth since then, with frequent announcements that a trade deal is imminent and therefore the tariffs are temporarily postponed, only to be walked back a day or two later. When an improvement is announced, stock markets on both sides of the Pacific rise quickly. When that announcement turns sour a couple days later, both markets quickly adjust back to the downside. This is the root cause of all the recent volatility in the equity markets.

So why is this just becoming an issue now?

It’s not; it’s actually been brewing for 18 years now (since China’s admission to the WTO in 2001). But whereas previous presidents have employed a more passive, look-the-other-way approach, our current Negotiator-in-Chief is taking a hardline stand. He’s vowed to reduce the number of stolen Fort Knox’s every year to zero. And it’s one of the rare issues where he’s mostly received bipartisan support.

Whether you like Mr. Trump or not, his hardball, New-York-style, take-it-or-leave-it negotiating tactics have the rest of the world taking his tariffs seriously. The Shanghai Stock Market declined 30% last year after President Trump implemented the first round of tariffs. After regaining some of that this year, the Chinese stock market is down another 12% in the last couple weeks as the standoff has intensified. Meanwhile, the US S&P 500 is down only about 5% over the same period. The trade war is not good for either country, but it’s really not good for China.

So where does this go from here?

This is perhaps the most critical idea to keep in mind with this trade war: We are each other’s largest customers and cannot continue to maintain our global dominance without each other. We both became #1 and #2 superpowers because of each other. We buy more of their stuff than anyone else in the world, and they buy more of our issued debt than anyone else in the world. We cannot exist without each other (well, we probably could, but it wouldn’t look like anything we’re used to).

Go back to your own business or profession for a minute. Think of your single largest customer. You may not like them personally, you may not agree with how they always operate, but so long as they continue to spend large amounts of cash in your business, you’ll probably find a way to put up with it. Can they ever be replaced? Sure. But it’s probably just easier to work on improving the relationship with each other first.

This is exactly what we’re doing with China. They are a great country. They have an incredible manufacturing network that we can’t rival from a cost perspective. They have almost 4x as many people in their country as we do. US companies would love to have access to those two incredible resources. But China knows this and is using it to their advantage, directly against the WTO agreements they signed in 2001.

Thankfully, China has more to lose right now that the US does. What they spend on us makes up less than 1% of our economy. But what we spend on them makes up 5% of theirs. When you’re talking trillion-dollar GDPs, that is a massive, massive difference. If they were to lose us as a trading partner, China would take a colossal economic step backward. It’s not going to happen.

So, in the end, this trade war will likely resolve itself with both countries making some concessions toward each other. We are not ‘going to war’ with China. It makes absolutely zero economic sense for either side.

Until that day comes (hopefully sooner than later), markets on both sides of the Pacific will be day-to-day volatile. In our conservative portfolios, we’ve reduced our exposure to China until the volatility subsides. In our more aggressive portfolios, we’ve been actively buying as the shares get cheaper and cheaper, but it may just hurt to look at the account statements for a bit.

(And China’s so-called ‘nuclear option’ – wherein they massively dump their US debt positions – would likely hurt them more than it would hurt us, but this is a different topic for a different day.)

[1] Hat tip to David Kelley at JP Morgan for this example