I concluded last week’s note by saying I’d summarize President-elect Trump’s financial and tax plans in this next note. But frankly, I’m tired of politics and ready to move on, and just as the election outcome showed, no one knows anything — it’s all guesstimates at this point.

But the following example will give us a pretty good idea of what to expect.

At the 2016 Kentucky Derby, the winning jockey, Mario Gutierrez, weighed in at 118 lbs (118lbs!) and his winning horse, Nyquist, ran at 37mph. Now imagine, what would happen if the jockey gained 20lbs before the Preakness Stakes two weeks later? Or another 20lbs before the Belmont Stakes 2 weeks after that? Neither Mario nor Nyquist would stand a chance at the Triple Crown. It doesn’t matter how hard that horse can run, a heavier jockey will always handicap the horse.

The US economy is the horse. The federal government is the jockey. Heavier jockeys make for slower racehorses. Easiest way to speed up the horse? Lighten the jockey.

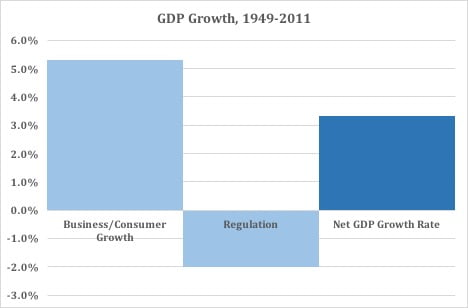

Before you think this is just a clever analogy, here is the underlying GDP data:

Source: John Dawson, John Seater

US businesses and consumers – the horse – are actually propelling the economy along at a 5% annual growth rate. Government regulation and compliance costs – the jockey – are slowing it down by 2%, which is why our annual growth rate comes in around 3% every year.

Most of our President-elect’s proposals call for lightening the jockey – simplifying the tax code, removing regulation, shrinking government payrolls, etc.

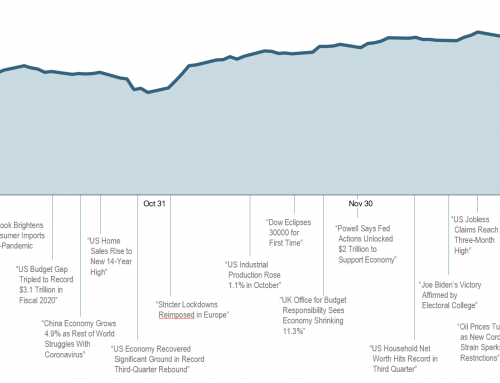

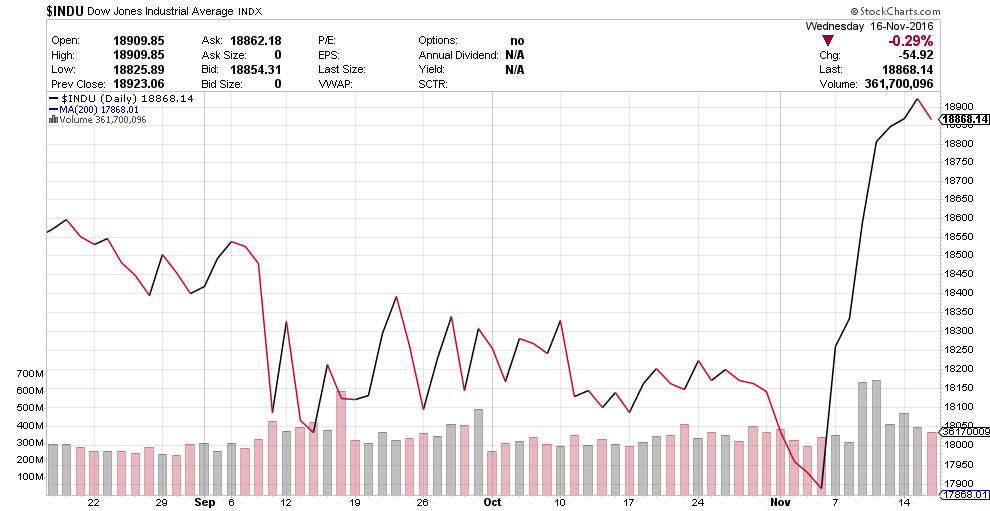

Here is what the capital markets think of a lighter jockey:

Lighter jockeys make for faster horses.

But that’s enough of politics for awhile. Let’s move on to something else.

Have a nice weekend, and enjoy your upcoming Thanksgiving weekend —