The Tiger’s sales continued to rise rapidly every year. At the same time, Knight began to face problems with the Japanese manufacturer and eventually started manufacturing his own brand of shoes in 1971 under the name Nike.[i]

The Tiger’s sales continued to rise rapidly every year. At the same time, Knight began to face problems with the Japanese manufacturer and eventually started manufacturing his own brand of shoes in 1971 under the name Nike.[i]Do you know who won the most medals at the Rio Olympics? It wasn’t the United States. It was Nike, whose athletes worldwide won more than 200 total medals and all 32 of the U.S. track and field golds.[ii]

Today, Nike is the world’s largest supplier of athletic shoes and sports apparel with more than 74,000 people employed worldwide.

Last fiscal year, Nike sold $39,117,000,000 of shoes, shorts, shirts and other merchandise (that’s $39 billion, with a B). To produce this, they bought $21,643,000,000 of cloth, fabric, rubber, and associated goods from other vendors and ran all these inputs through it’s $4,740,000,000 of plants and factories to produce their final products. Nike spent an additional $12,702,000,000 in general overhead getting all these final products sold, but this still left a cool $4,772,000,000 in profit leftover.

Now, just where exactly does this $4,772,000,000 go? All back to Knight and Bowerman?

Quick answer is no.

Then who are the owners, and what do they do with $4.7 billion each year?

The fact is that Nike is not owned by any one person, but rather by thousands, if not millions, of different people and institutions, each owning a different number of shares. Phil Knight is still the largest single individual investor with 12 million shares, but even this only represents about 1% of the entire company. Mr. Knight is entitled to 1% of that annual $4.7 billion in profit (a pretty good return on his original $1,000 investment), with the remaining 99% going to all of his fellow investors.

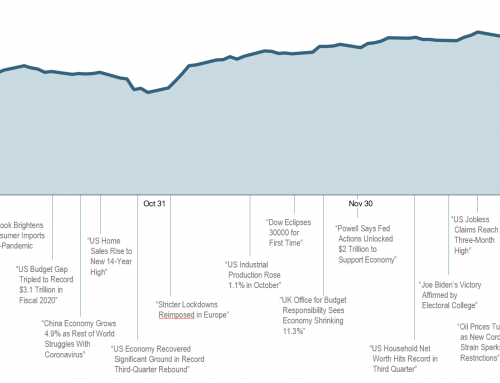

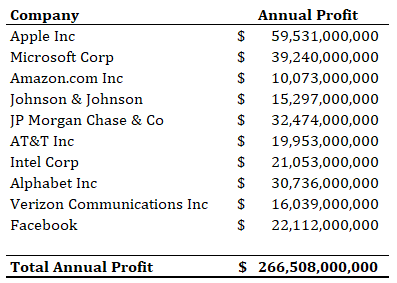

As large as it sounds, $4.7 billion is not all that big. Here are some other popular names:

All that profit went back to the shareholders in some fashion: either by paying down debt, buying back shares from existing stockholders, investing in more R&D/employees/factories to produce even more stuff to sell, or by sending dividend checks to the shareholders of record.

That’s a lot of money to pass out.

So how do I participate in all of this? It’s really quite simple: purchase shares of stock in these great companies, either directly or via a mutual fund or index fund or similar. Got $50 in your pocket? That will buy you a share of Intel. $73 will get you a share of Exxon, Facebook about $187, and Apple about $218 (Berkshire Hathaway will set you back a cool $320,850…seriously).

We’ve long held that our favorite single investment is shares of ownership in the greatest companies in the world. Look again at the names in the list above. These, along with thousands of others, will continue to distribute profits to their owners as long as there are customers with problems to solve and smart companies willing to solve these customers’ problems. That is a trend that is likely to last forever.

Whether I choose to participate as an investor in these great companies is my own decision.