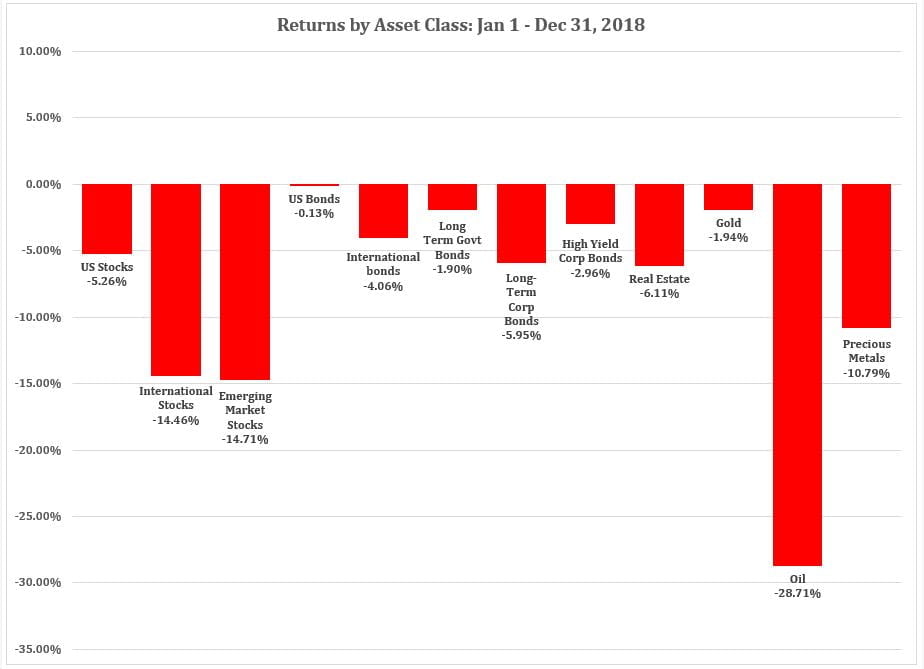

Returns for 2018 have been frustrating. Mostly because there haven’t been any:

See endnote for data sources.[i]

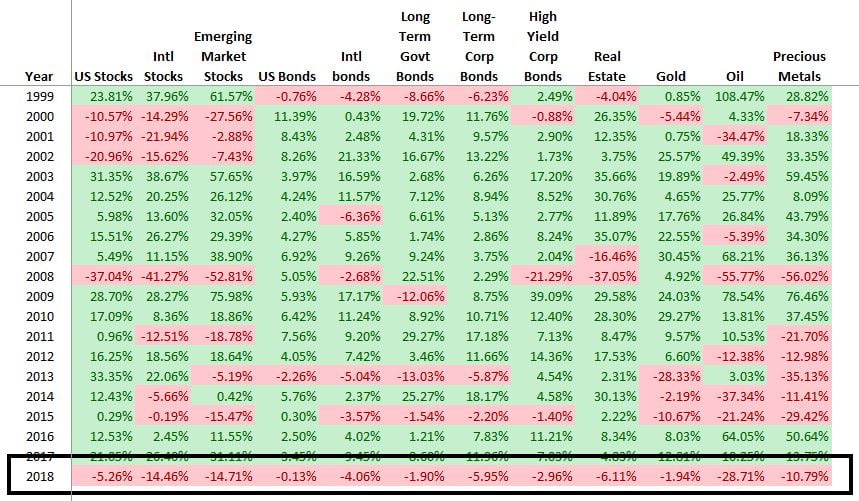

Diversification – the basic notion to NOT to put all your eggs in one basket – has historically helped investors as some asset classes tend to zig while other asset classes zag. But even that didn’t work this year:

See endnote for data sources.

Which is even stranger because currently:

- Real Gross Domestic Product is at an all-time record high, because industrial production is record-high, as is retail, as is services;

- Corporate earnings are at an all-time high;

- Unemployment is at a 49 year low, with more jobs currently open nationwide than workers available to fill them;

- Consumer sentiment is higher than it’s been in 15 years;

- Americans’ personal financial statements are healthier than ever, with more disposable personal income than ever, and the lowest number of bankruptcies filed in 24 years;

- With Inflation very much in check.

Wait….. how does a red-hot economy produce such lackluster capital market returns across the board?

The given reasons surround a couple themes:

- A simmering political trade war between the first and second largest economies in the world;

- The Federal Reserve raising rates to prevent the economy from overheating;

- Concern about how much more room this economy has to run;

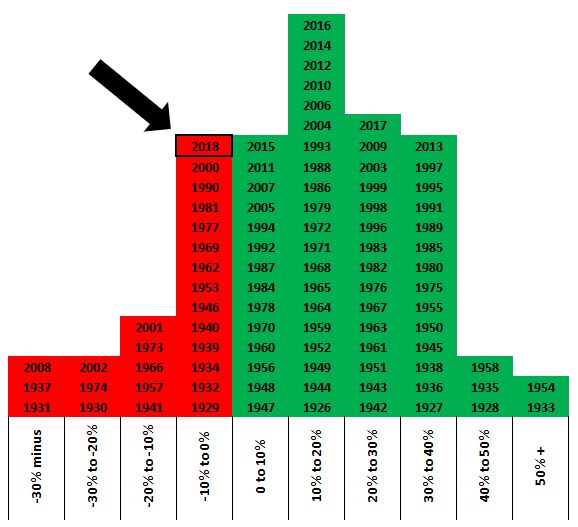

Does this mean we should pack it all up and head for the hills? No. As frustrating as 2018 returns were, they were pretty normal in the grand-scope-of-things:

See endnote for data sources

Of the 93 annual returns since 1927, about 25 (about 27%, or 1-in-4) have been negative. This also means that 68 have been positive (about 73%, or 3-in-4). In other words, as an investor, I should just get accustomed to 3 steps forward, 1 step back; 3 steps forward, 1 step back (or thereabouts). Lo-and-behold, of the last 20 years (see Chart 2 above) 2018 was the 5th year in the last 20 (or 25%) that turned into a negative return. Pretty normal behavior.

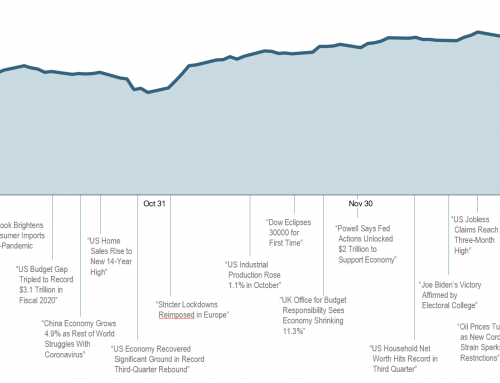

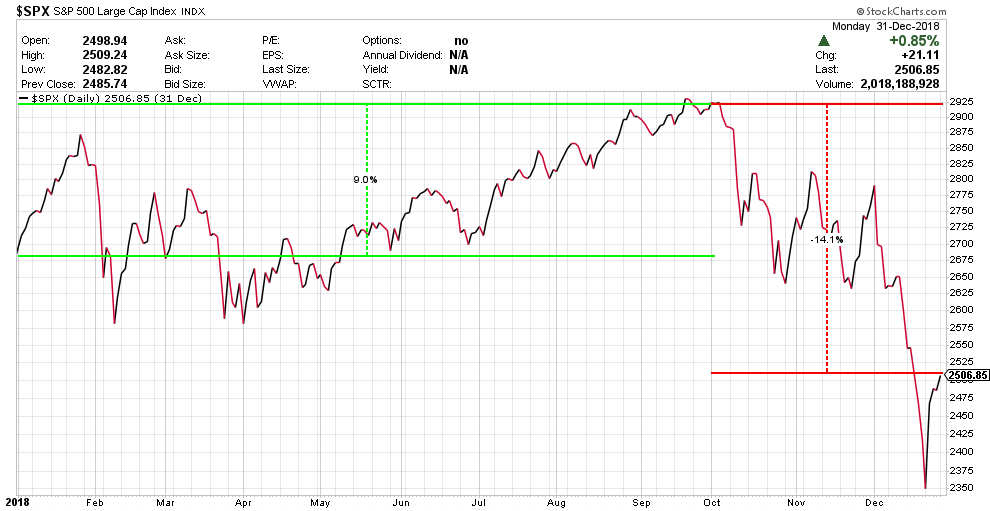

Now, to be sure, the 4th quarter of 2018 was particularly volatile:

Source: Stockcharts.com

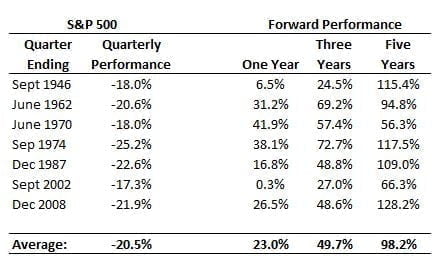

After putting up a decent run for the first 3 quarters of the year (about 9%), the SP 500 declined ~14% in the final quarter (down ~19% at one point). Scary, for sure, but certainly not new. Here are the scariest quarters since WWII, with their subsequent returns thereafter:

“Yeah, but haven’t you seen what’s going on in the world!?! 2018 is different!!” Um, kind of:

- 1946: Winston Churchill gives his famous “Iron Curtain” speech in the US, warning of the increasing tension between the US and Russia after World War II; a major 7.4 magnitude earthquake hits near Alaska, producing 60-foot waves and eventually reaching Hawaii; 30 million people are close to dying because of starvation in China; U.S. Troops seize control of US railroads during a rail unions strike. Dean Martin begins his music career.

- 1962: Cuban Missile Crisis: Russia plans to deploy missiles in Cuba, some 90 miles off the coast of Florida; President John F. Kennedy calls Russia’s bluff and threatens war; NASA’s Ranger IV spacecraft crashes into the moon; Federal troops and US Marshalls deployed to University of Mississippi following riots over African-American enrollment; John Glenn orbits the earth, Marilyn Monroe sings Happy Birthday to JFK, and Sam Walton opens his first WalMart in Bentonville, AR.

- 1970: US invades Cambodia as part of the Vietnam War; Anti-war protests at Kent State University and Jackson State University end with several students shot by the National Guard; a cyclone in Bangladesh kills 500,000, an earthquake in Peru kills 67,000, wildfires in Australia kill 75, and a structure fire at a nightclub in France traps and kills 142 teenagers; an oil tanker spills 100,000 gallons of oil into the English Channel; the US lowers the voting age to 18, the Beatles release “Let it Be”, Simon & Garfunkel release “Bridge over Troubled Water”, and the Boeing 747 makes it’s first commercial flight.

- 1974: US President Richard Nixon resigns following Watergate scandal; the Irish Republican Army bombs mainland Britain; Franklin National Bank in New York fails after borrowing $1 billion from the Federal Reserve, the largest ever bank failure at the time; OPEC enforces an oil embargo against the US, gasoline prices skyrocket as supplies are rationed, highway speed limits of 55MPH are imposed and daylight savings time is introduced, all to save energy; inflation runs to 12.3%; smallpox in India kills 20,000, and the largest series of tornadoes in history – 148 in a 24 hour period – hits 13 US states, killing 315 and injuring over 5,000. The Sears Tower in Chicago becomes the world’s tallest building, Eric Clapton releases “I Shot the Sheriff”, and Leonardo DiCaprio, Alanis Morrissette, and Jimmy Fallon are all born.

- 1987: US President Ronald Reagan implores Soviet Union President Mikhail Gorbachev to “tear down this wall”; the Tamil Tigers plant a massive bomb in the Sri Lankan capital, killing more than 100; a subway in King’s Cross Tube Station in London catches fire and kills 31; Iraq attacks the USS Stark, killing 37 US sailors; a ferry collapses in Manilla, killing 4,000; the Dow Jones Industrial average declined 22.61% in one day – Australia declined 41% and Hong Kong by 45%; despite this, the Dow comes roaring back in the next several weeks and finishes the year +2.26%; The Simpsons debuts (eventually surpassing Gunsmoke as the longest running TV show), Aretha Franklin is inducted into the Hall of Fame, and disposable contact lenses become commercially available.

- 2002: US Airways files for bankruptcy the first time (second time in 2005); Kmart Corp, WorldCom, and United Airlines also files for bankruptcy; Mount Nyiragongo Volcano erupts in Congo, displacing 400,000 people; Queen Elizabeth dies; Chechen rebels take 800 theatergoers hostage in Moscow – special forces storm the building but 128 hostages and 41 rebels are killed in the firefight; 2 snipers in Washington DC kill 10 people and injure 3 more; tornadoes strike the southern US on Veterans Day, killing 36; Elizabeth Smart is kidnapped in Salt Lake City; wildfires in Oregon and Colorado burn almost 600,000 acres; The Mars Odyssey finds signs of huge ice deposits on the planet Mars; Kelly Clarkson wins first American Idol Contest; Lord of the Rings and Harry Potter: Chamber of Secrets are popular in film.

- 2008: Oil hits an all-time high of $147/barrel; Illinois Governor Rod Blagojevich is arrested on federal corruption charges – House of Representatives votes 114-1 to impeach; Myanmar tropical cyclone kills over 50,000; Chinese earthquake in Chengdu kills 60,000 and leaves 5 million homeless; property values in America and Europe decline, leading to the default by many subprime borrowers; loan losses begin cascading through American financial system; Bank of America takes over Countrywide Financial to stave off a $4 billion bankruptcy; Lehman Brothers fails (158 year old bank), Washington Mutual fails (119 year old bank), Bear Stearns fails (85 year old bank); Fannie Mae, Freddie Mac, AIG nationalized; Congress creates TARP, TALF lending programs, and bails out GM, Chrysler, and Ford; by the end of the year, the Dow has declined -33.8%; Olympics held in Beijing; Blu-Ray DVD takes over majority of HD sales; Apple debuts ultra-thin MacBook Air; US Missile System successfully detects a falling satellite and blasts it out of the sky, displaying their precision technology to the rest of the world; Barack Obama defeats John McCain for the office of US President.

So yes, I guess 2018 is a bit different. But not really. The world has always been a scary place; it’s been scary before, and it will be scary in the future. There will certainly be scary moments in 2019, but there will also be new triumphs. We will reach new highs and new lows across the spectrum – technology, media, politics, economics markets, and as human beings living in an unpredictable world.

This is a time for patience and discipline:

- Patience to understand we’ve been here before many times and we’ll be here again many times in the future. Returns don’t come each year (refer back to Chart 2 or Chart 3 above), but they do come to those who are patient, and those who:

- Have the discipline to stick to the long-term plan. The absolute worst time to make a change to your investment philosophy is when your thinking is emotionally clouded in recency bias. Emotions are a part of life, but they should not be part of your investing life.

No one investment strategy works all the time. If it did, the entire world would be there. The best investment strategy is the one that you can stick with – the one that allows you to get a reasonable return and still be able to sleep at night.

In our conservative portfolios, we’ve trimmed some of our more aggressive positions until the volatility dies down a bit. In our aggressive portfolios, we’ve continued to buy each month, but those account statements are not comfortable to look at – just like they wouldn’t have been in 1946, 1962, 1970, 1974, 1987, 2002, 2008, or any of the other volatile periods in the capital markets. Risk and return are always related, and this is the risk that creates the return.

I’ve shared this before, but this video from our friends over at Loring Ward illustrates investing in times like these:

Here’s to a prosperous 2019.

(P.S. Last week, all the media the wanted to talk about was how the markets had turned in their “worst performance in over a decade.” Since then, the markets have also since turned in their best 10-day run in over a decade – that part didn’t make the news.)

[i] Vanguard Total Stock Market Index Fund (VTSMX), Vanguard Developed Markets Index Fund (VTMGX), Vanguard Emerging Markets Stock Index Fund (VEIEX), Vanguard Total Bond Market Index Fund (VBMFX), PIMCO Global Bond Fund (PIGLX), Vanguard Long Term Treasury Fund (VUSTX), Vanguard Long-Term Investment Grade Fund (VWESX), Vanguard High Yield Corporate Fund (VWEHX), Vanguard REIT Index Fund (VGSIX), Gold Fixing Price in London Bullion Market 3:00 PM (London time) 1972-2004, SPDR Gold Shares (GLD), WTI Crude, Vanguard Precious Metals Fund (VGPMX)