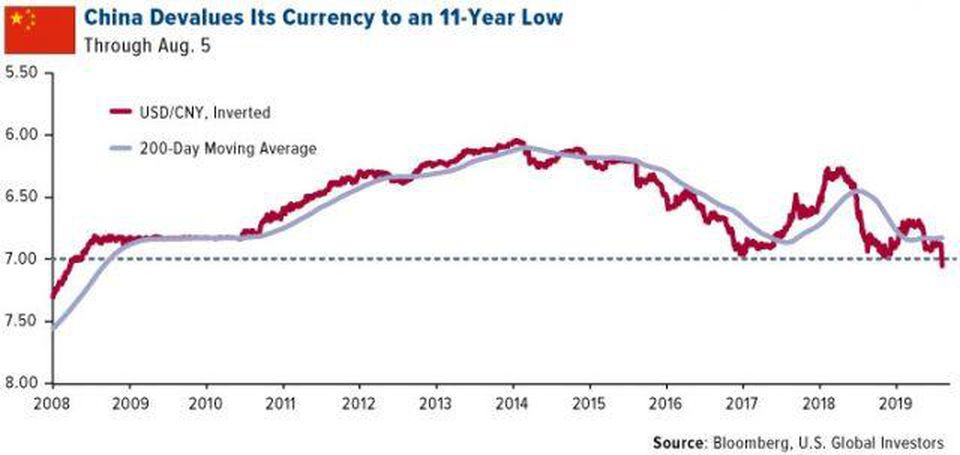

America fired another round of shots across China’s bow Monday evening when US Secretary of Treasury Steven Mnuchin formally labeled China a currency manipulator.

This was in response to China allowing its currency to slide relative to the US Dollar Monday morning (more on that in a minute), which was in response to President Trump’s late-Friday tweet that he was adding another round of tariffs, which was in response to another round of failed trade-agreement negotiations between the two superpowers last week.

Though calling someone a currency manipulator sounds akin to an elementary school playground tantrum, there’s more to it than that. It kicks off some formal processes at the International Monetary Fund and adds political weight to any argument from the Trump administration for further tariffs against the communist regime.

Trump has been hurling this insult for months, but it does require the formal declaration from the Treasury Secretary before it has any merit, and most Treasury Secretaries have been extremely reluctant to do so (even Mnuchin declined Trump’s request as recently as a couple months ago). The last time the US used it was 1994 – 25 years ago – against China then as well. Things boiled over Monday evening, and Mnuchin finally lobbed the currency-manipulator grenade across the pond.

All of this is escalating the long-simmering trade war we discussed a couple weeks ago into a full-blown currency war. Not good.

But to understand the mechanics of what this means, let’s use a simple hypothetical example to illustrate.

Let’s say that I – as an Idaho resident – am in the market for a new car. I shop around at all the local dealerships here in Idaho and find that the going rate for the car I want is about $34,000. Out of curiosity, I check prices in Salt Lake City and find that the exact same car in Utah is going for about $30,000 — $4,000 less! If I make the 2-hour drive south, I can save $4,000. What would you do? Most all of us would take the afternoon off and head south.

BUT, let’s say that the Sovereign State of Idaho and the Sovereign State of Utah are in a tiff with each other (Utah has been stealing our potato recipe). The Idaho Governor, attempting to Make Idaho Great Again (#MIGA?), declares by Executive Order that any car purchased in Utah and brought back to Idaho will have an additional 20% tax levied on it and collected at the time I try and register it here in Idaho. Ouch. That $30,000 car in Salt Lake will now end up costing me $36,000: $30,000 car + $6,000 anti-Utah tax. I grumble and buy the $34,000 car in Idaho.

This is exactly what a tariff is and how it works.

Now let’s add the currency effect:

Let’s say that the Sovereign State of Idaho has its own form of currency – Idaho Dollars – and the Sovereign State of Utah has its own form of currency – Utah Dollars (follow along with me here…. I said this would be hypothetical….). Though they are different forms of currency, they’re usually freely interchangeable and the exchange rate is mostly stable against each other. It’s been this way for years, and citizens of both states are comfortable with the process.

BUT, since the Idaho Governor won’t back down on his 20% anti-Utah tax, the Utah Governor arbitrarily devalues the going rate of the Utah Dollar statewide by 10%, meaning that $30,000 car in Utah now only costs the Idaho resident the equivalent of $27,000 of his Idaho Dollars ($30,000 minus 10%). Now, it does suddenly make sense to drive south. I can pay $27,000 for the car, and pay the 20% anti-Utah tax of $5,400, and still only be $32,400 out of pocket, less than the $34,000 I was going to pay for the Idaho car. By de-valuing his own currency, the Utah Governor effectively circumvented and negated the Idaho Governor’s anti-Utah tax! The Utah Governor and his advisors chuckle when they see how miffed the Idaho Governor is on the news that evening.

Furthermore, because most everything is now cheaper in Utah (because of the devaluation), Colorado Dollars start flowing into Utah, Arizona Dollars start flowing into Utah, Nevada Dollars start flowing into Utah, etc. Utah’s economy is rocking.

Idaho’s Governor cries foul. He labels Utah as a currency manipulator.

So why doesn’t the Idaho Governor simply devalue his currency to match? Because he can’t. His is an open, free-floating currency. Actually, pretty much all states’ currencies are open and free-floating (except Utah in this example, more on that in a minute). The price of an Idaho Dollar is whatever someone in Montana or Oregon or Wyoming or Washington or Nevada is willing to pay for it. It’s driven by free-market supply and demand, not the Governor or his Treasury.

The only reason the Utah Governor can influence the value of his Utah Dollar is because his currency is closed, pegged, and not free-floating. His is a communist nation, a communist economy; he controls it all. For years, his Treasury has met every morning to either add more Utah Dollars into the economy or take Utah Dollars out in order to keep the exchange rate artificially pegged 7-to-1 against the Idaho Dollar. It doesn’t free-float like the rest of the world; it’s arbitrarily pegged by the Treasury. Because it’s pegged and not market-driven/free-floating, most of the rest of the world doesn’t trust it. But they have to go along with it anyway in order to do business there.

(Clearly, this hypothetical doesn’t really work in real life as our US Constitution prevents any state from creating their own currency or impeding interstate commerce via tariffs, but you get the point…)

Ironically, when China devalued their currency this week, they actually didn’t devalue it – the free market did. China stopped propping it up for a day; the rest of the free market recognized it was overvalued and let its value slide to free-market equilibrium. In other words, China was not manipulating their currency by letting it slide – they’ve been manipulating it by keeping it artificially propped up.

China devaluing its yuan negates the effects of the US tariffs – effectively undoing the last several months of Trump’s negotiations. This ups the ante for Trump’s next move, which brings a lot of uncertainty, and uncertainty brings caution. Investors manifested their caution by removing ~1,500 points from the Dow Jones industrial average this last seven days, down about 5.5% in one week.

So, where do we go from here?

We stay the course. This trade war will continue for a while, and there will be lots of ups and downs until an agreement is struck. As I said before, this is a long-brewing, very-complex issue between the world’s two largest superpowers. If there was an easy fix, it would have been done already. We are each other’s largest customers; it’s in both of our best interests to make sure this has a positive outcome. It just might be rocky getting there.

The Dow tumbled almost 800 points the other day. That’s never pleasant. But just remember, for every seller there is a buyer. When the Dow drops by 800, what is it that the buyer knows that the seller does not?

By now, you know our long-held mantra for long-term success in the capital markets: knowledge of how markets work; patience, for when it appears markets do not work, and discipline, for when I’m tempted to throw the first two points out the window.

We agree with Mr. Buffett:

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett