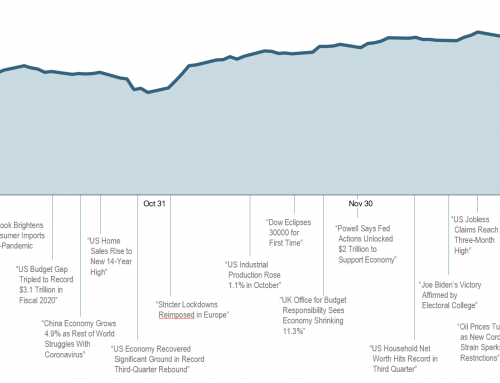

The US stock market is calm right now — unusually calm. Consider a couple points:

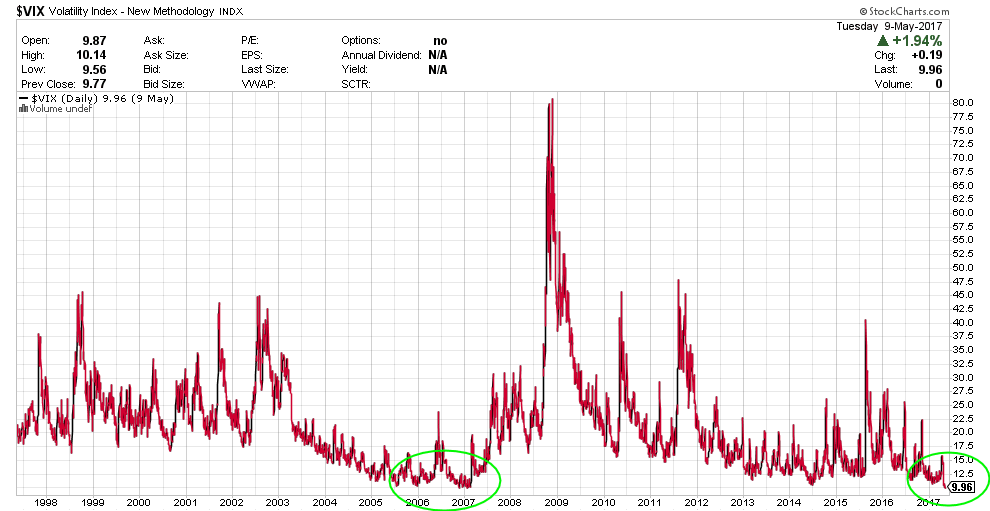

The VIX Index – an index of expected volatility in the markets, where higher numbers imply greater uncertainty and volatility, and lower numbers imply less uncertainty and volatility – dropped this week to a level not seen since 2006:

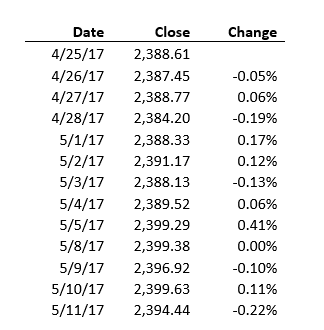

The SP500 Index, a basket of the 500 largest US companies, hasn’t hardly moved in the last 13 trading days:

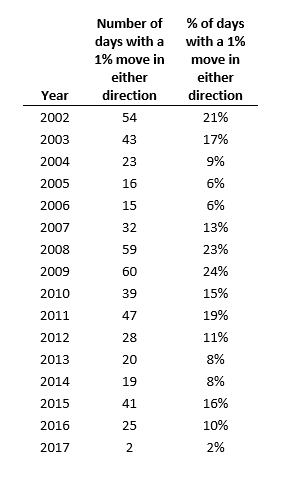

And compared to pretty much every other year in recent history, 2017 has been unusually low as far as wild daily movements in the market:

Based on averaging the data above, we should expect the market to move up or down by 1% in a single day about 35 days every year. So far this year, we’ve seen 2. Granted, it’s only May, but even if we double or triple or quadruple what we’ve seen this year, it will only bring us to 4-8 wild days in the market – a far cry from the 35 days we should expect.

The problem is that we do not know if this is good news or bad. We don’t know if this is the calm before the storm, or the calm after the storm.

But we do know there is never glassy water on the ocean — at least not for very long.