About a week before last Thursday’s historic vote, I sent a note out and concluded:

“…in the grand scope of things, Britain staying or going will have very little long-term impact on your portfolio. Sure, we might see some volatility for a bit – just like we do with every currency crisis, sovereign debt fiasco, etc…”

Do you believe me now? 🙂

Many people had not heard of #Brexit before my note 10 days ago. But after this last weekend, it’s become a household word. Although Thursday’s outcome doesn’t change our long-term thinking, it does give us more information. Here is an update of what you need to know:

What just happened?

- On Thursday, UK voters voted to leave the European Union by a very slim margin: 52% to 48%, with a 72% turnout rate. By comparison, in the last US Presidential election, turnout rate was about 57%. This was a big vote.

- Prime Minister David Cameron (the British equivalent of the US President) vowed to resign shortly and turn the government over to new leaders by this fall.

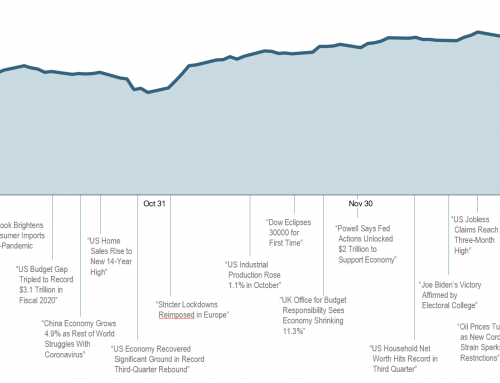

- The British Pound fell in value immediately against all major currencies (see chart below against the US Dollar). Think of this as a vote of no confidence among Britain’s international trading partners.

- Risky assets – such as stocks and currencies – were clobbered in the aftermath of the vote. European stocks are down 9% in 2 days and their US counterparts are down about 5%.

- Traditional safe-haven assets – US Treasuries, gold, the US Dollar and the like, have rallied strongly as investors globally have sought the safety of the US (and in doing so, bid up prices accordingly).

So, what will happen from here?

- No country has ever left the EU before, so Great Britain is truly heading into uncharted waters. This uncertainty is what is driving most of the volatility. Because global economic growth has been so anemic over the last 18 months – especially in the euro area – a dramatic change such as this is rocking the boat and investors are being cautious until they have more information.

- The giant search engine Google reported extraordinary spikes in searches among Britons for “What is the EU?” after polls closed for the night, suggesting some voters (especially those younger) may not have been fully aware of what they were voting for. Furthermore, some of the most prolific Leave campaigners have started backpedaling on their claims, and a petition to hold a second referendum has now reached 3 million signatures.

- To calm volatile markets, the US Central Bank, the European Central Bank, and the Bank of Japan (the 3 largest central banks) have all pledged to pump liquidity into the system if needs be. So far, this has not been needed, and unless something dramatic happens in the next couple days, will not be needed.

So, should I be making any changes to my portfolio?

- The key thing to remember is that Britain is not imploding; they’re simply going out on their own. Tomorrow, Britons will wake up and still need the same housing, the same transportation services, food, clothing, medical care, entertainment, and recreation they always have. They still have jobs that produce the same amount of income and will still spend their money with their economic trading partners. Their economy will go on; they’ll just be moving forward detached from the mothership.

- Although the thought of ‘going it alone’ without the EU sounds scary, remember that both Switzerland and Norway – two of Europe’s rock-solid economies – are intentionally NOT members of the EU.

- Britain represents about 4%-5% of global GDP. The US will be relatively insulated. This will lower the global growth outlook slightly and the Fed will likely delay further rate hikes for a bit. But let’s keep this in perspective: When you woke up this morning, other than a blip on your 401k statement, did last week’s Brexit vote have a material impact on your personal life? Mine neither.

- In the portfolios we’ve built for conservative investors, we sold our European stocks over a year ago and haven’t owned US stocks in a couple months. Furthermore, we have a decent position in long-dated US Bonds, which are up almost 5% in the last couple days. These portfolios are built for events like this.

- In the portfolios we’ve built for aggressive investors, we still hold both US stocks and to a lesser extent, European stocks. These portfolios are built for truly long-term investors. Will I kick myself for having owned euro stocks this month? Probably. Will I smile 15-20 years from now when I look back at what I bought them for back when it was ‘scary’ – kind of like China melting down 6 weeks ago (remember that?), the Greece fire in 2015, the Russian financial crisis (2014, or 1998 – take your pick), the Asian Crisis of 1997, or the Swedish Banking Crisis of 1992? Probably. It’s almost hard to believe, but these are ‘normal’ market events. This is the risk that drives the return.

I’ll conclude with the last half of my note from last time:

“…take it in stride, stick to your plan, and keep the long-view…”