Neither of those words are found in Webster’s dictionary. But they’re both all over the popular media right now. They both refer to potential outcomes of the upcoming British referendum vote to stay in the European Union or to exit. This vote will be placed before its citizens next Thursday, June 23. Our British friends will vote to either stay in the EU, or leave.

Here is what you need to know:

Both sides have reasonable arguments. Those wanting to leave the union contend that they will save billions on EU membership fees, retain more sovereignty, and maintain better control of their borders. Those against the exit argue that it will lead to decreased international political power, decreased trading with other countries, and general economic uncertainty. Polls currently show it’s an almost even split between the two options; it will be up to the citizens next week to decide.

An easier way to understand what’s happening is to use a hypothetical example of a formal business partnership between 5 physicians. Many years ago, these 5 independent doctors began discussing the advantages of formally working together – shared staff and overhead, better pricing with vendors, and more political power when negotiating with the hospital. They each agreed the partnership would be a net positive, and each signed the agreement formalizing their working arrangement.

Several years went by, and by-and-large, the partnership worked well. However, after many years, one of the older, more independent doctors is thinking about going back on his own. He’s always been the one partner that was somewhat aloof – he never fully participated in the partnership. He tells the other partners he wants a better deal or he’s leaving. He argues that he will not have as many expenses on his own and that he will have more control. The others remind him of the increased administrative burden of being on his own and contend that he won’t have the same pricing power, bargaining leverage, or public visibility (and thereby, new patients) that the larger partnership offers. He tells them he will give them a final answer next Thursday, June 23. Everyone involved is tense and anxious, ready to have it resolved.

If he leaves, the partnership will have a hole to fill; his practice is strong and stable and productive to the partnership. In order to entice him to stay, the partnership will likely have to offer him more in exchange – more money, more control, more independence, whatever. The larger concern is that if he leaves, it may prompt 1-2 others to consider the same thing and before too long, the entire partnership is at risk of disintegrating.

This is exactly what the Bremain/Brexit vote is about. The United Kingdom is one of the larger, more established countries belonging to the European Union. But they’ve also always been half-in, half-out. They are one of the few to not adopt the Euro as it’s common currency and were also only 1 of 2 countries (of the 26 in the EU area) that opted-out of the Shengen Agreement – a pact wherein fellow citizens of neighboring EU countries could cross each other’s borders without needing visas or similar border-control documents.

The UK is now putting a formal vote before its citizens next week to leave the partnership – the EU – or remain. Both sides have some positives and some negatives. But everyone involved is tense and anxious to have it resolved. The greatest concern – and greatest unknown – is the economic impact of the vote. Both sides are a bit uneasy, and you’re seeing this tension and uncertainty manifest itself in the capital markets.

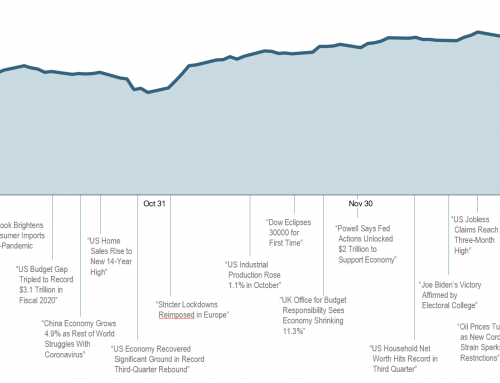

Euro area stocks are down about 4% over the last 30 days. German government bonds – a typical safety refuge during market volatility – have been bid up over the last several days, pushing yields into negative territory earlier this week (price and yield are mathematically inverse to each other – when prices go up, yields go down). But think about that for a minute – instead of earning a return, investors are actually paying the German government to hold their money for them! This shows the increased level of uncertainty around next week’s vote.

So, what should we do about it? You know our answer – stick to your plan. In the grand scope of things, Britain staying or going will have very little long-term impact on your portfolio. Sure, we might see some volatility for a bit – just like we do with every currency crisis, sovereign debt fiasco, etc – but the long-term impact will be negligible. In our conservative portfolios, we haven’t owned European stocks in over a year. In our more aggressive portfolios, we’re still holding them and expect a turbulent ride for the next little bit until things settle back to normal. But this is exactly the risk that creates the return.

Take it in stride, stick to your plan, and keep the long-view.