I broke my arm twice as a teenager – once on a skateboard, once on a snowboard.

The first break was relatively minor and ended up with me being soft-casted for 3 weeks. This was tolerable because I could take it off to shower and occasionally stretch my arm.

The second break was more severe and ended up with me being hard-casted for a good 6 weeks or so. By the time the doctor cutoff that nasty cast, my arm was limp, weak, and atrophied from not being used for so long. He told me to be very careful with it as it would be prone to additional injury until my strength had returned.

It’s the same principle with our economy. We just subjected the economy to a nasty compound fracture. Federal, state, and local governments have temporarily soft and hard-casted several different aspects of our lives: work, travel, recreation, and leisure.

The longer we wear the cast, the more the economy atrophies. Getting the economy back to full-strength will depend on how long these restrictions are in place, and how diligently we ‘exercise’ our economic muscles once the casts come off.

Recoveries generally come in 3 main flavors:

- V-shaped

- U-shaped

- L-shaped

Let’s go back to 2008 and see 3 different countries go through 3 different recoveries:

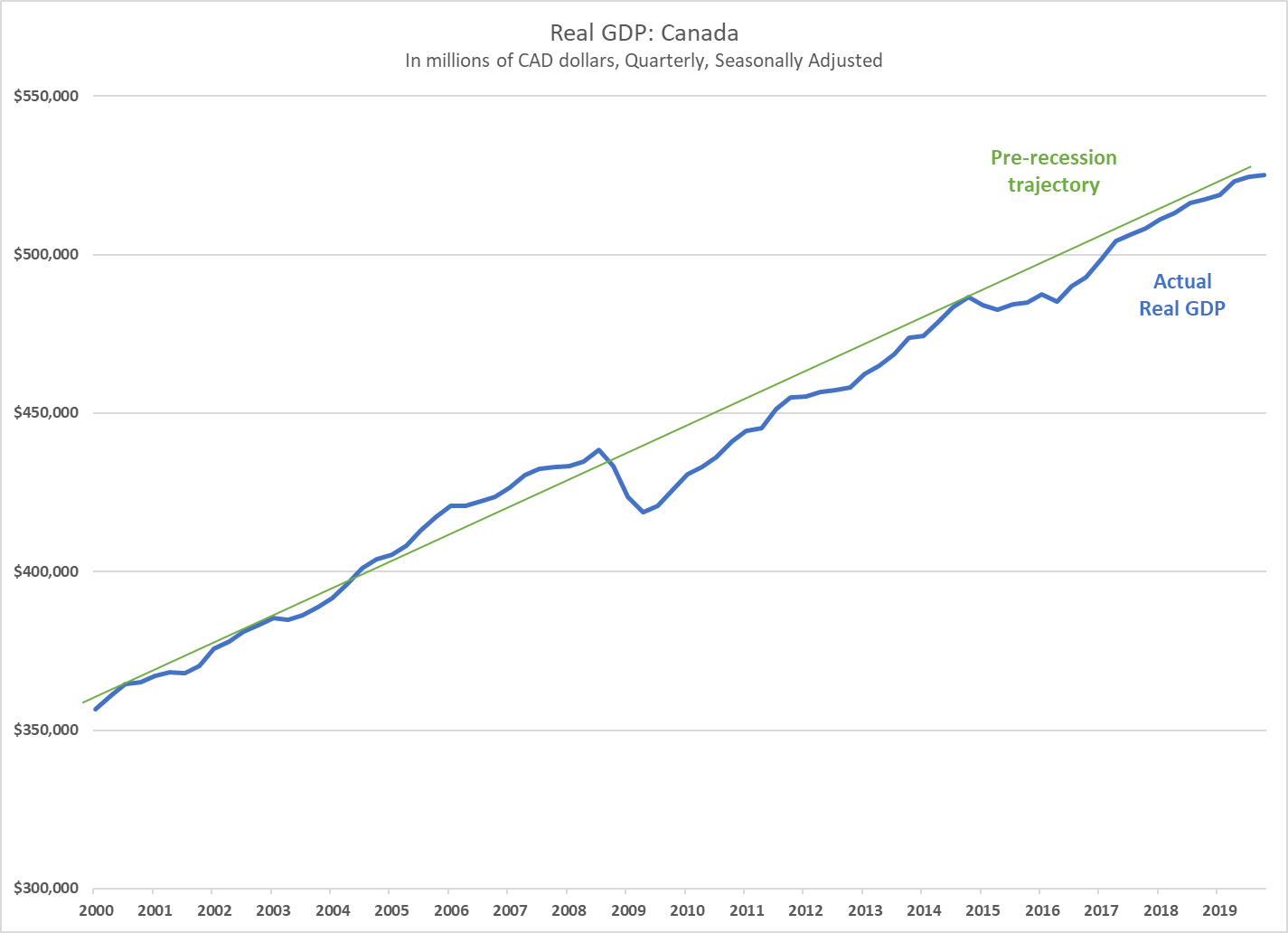

V-shaped recovery: Canada

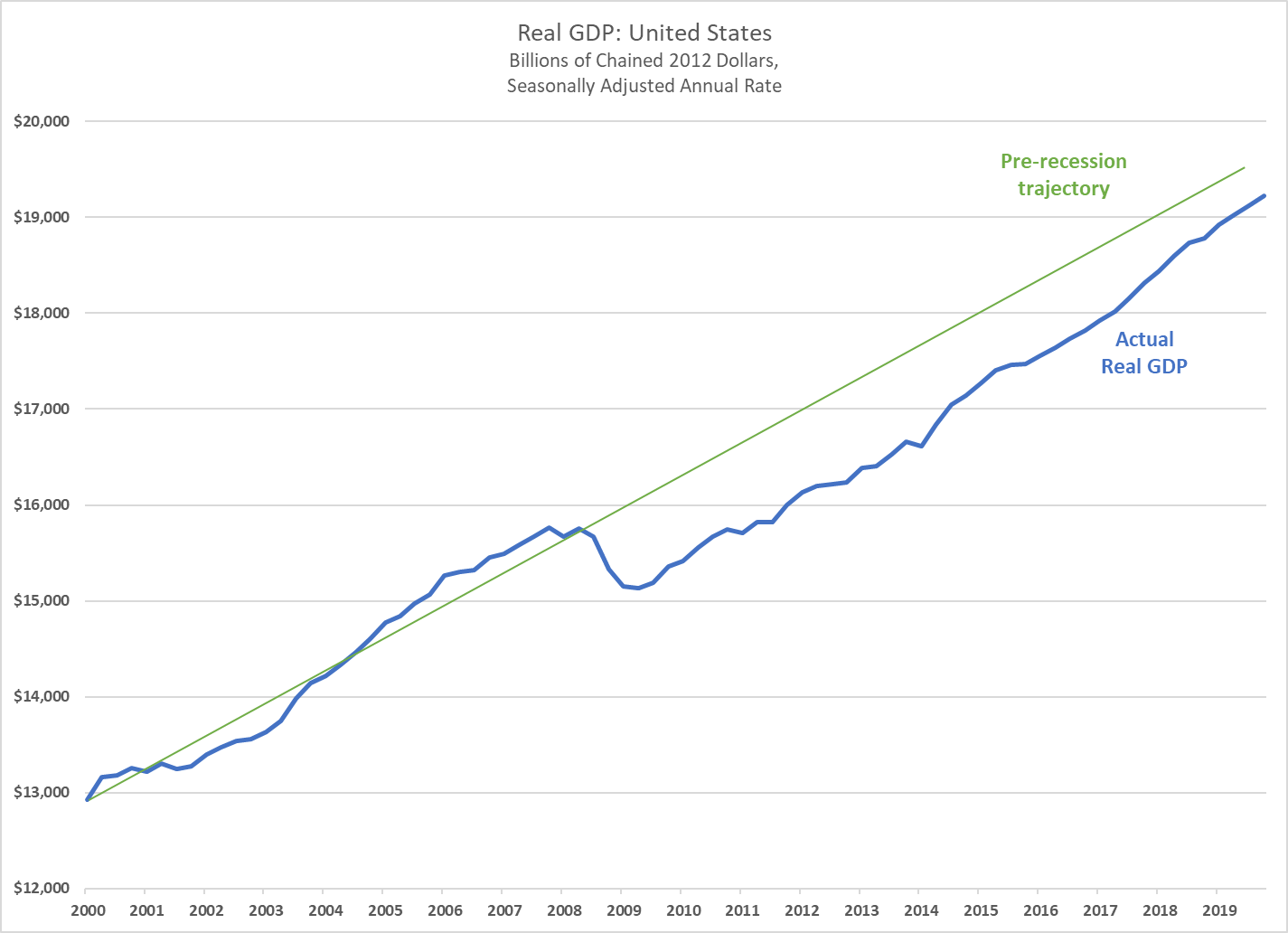

U-shaped recovery: United States

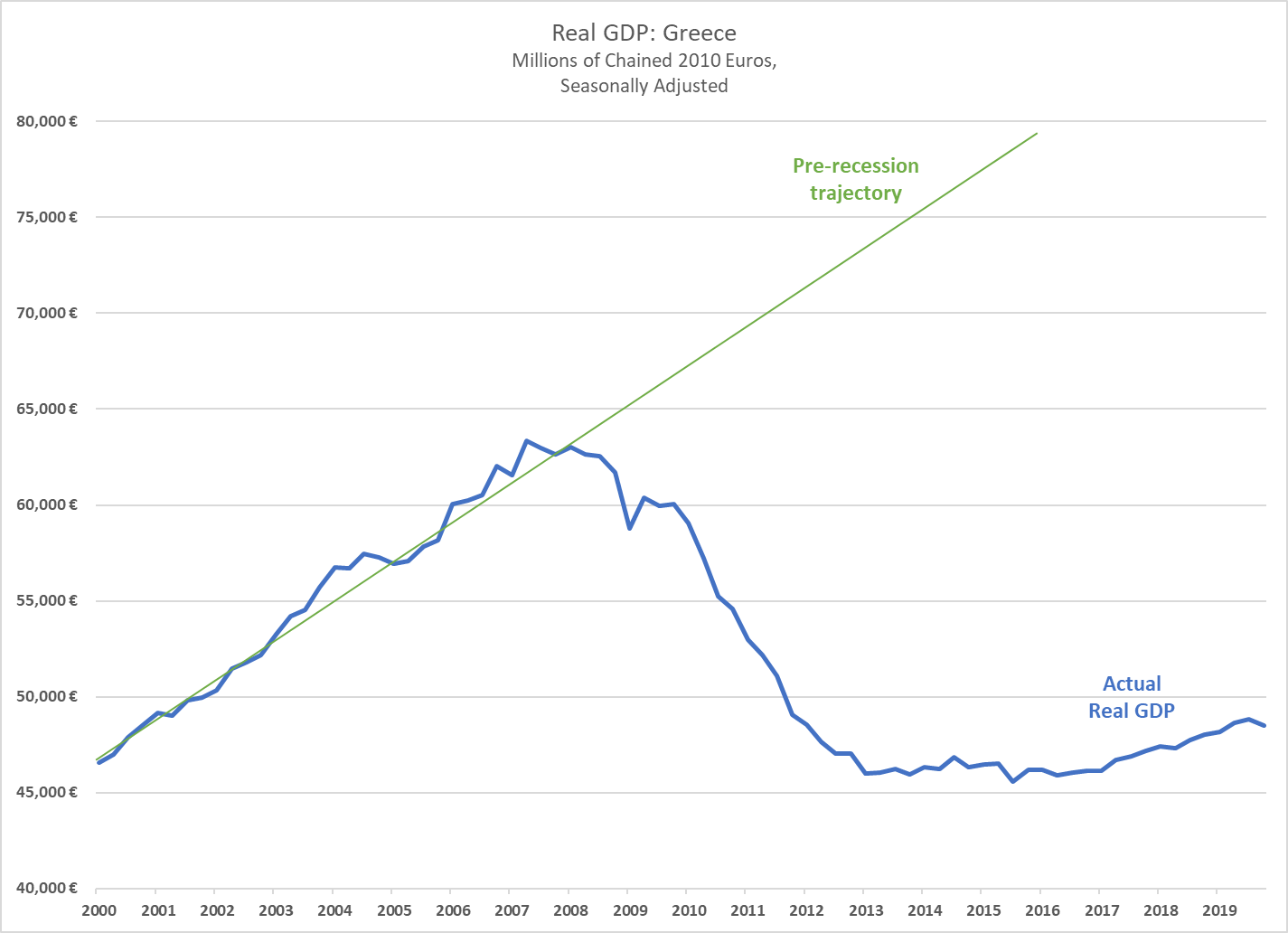

L-shaped recovery: Greece

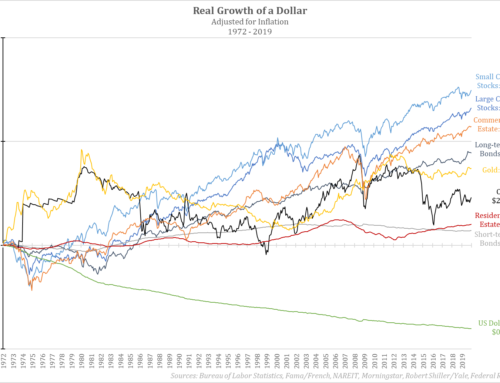

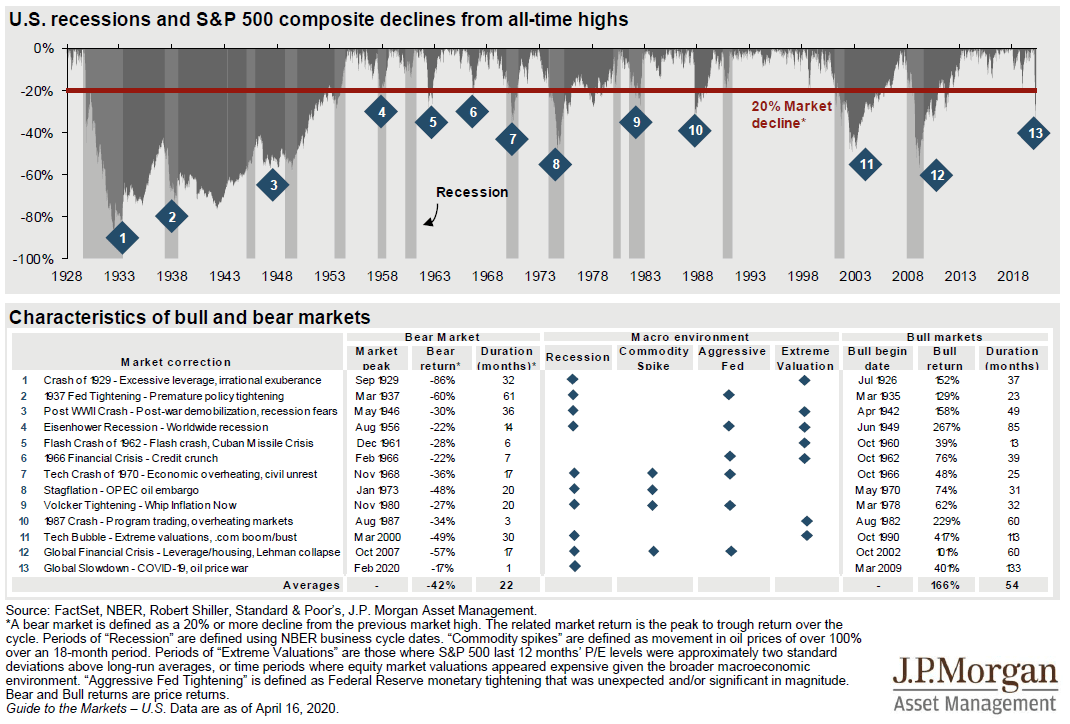

We’re all wondering what the recovery from this COVID-19 induced recession will look like. No one knows. And we’re all a little jaded by the ‘r-word’ since the last two – 2001 and 2008 – were so brutal. But as I wrote several months ago in Not all Bears are Grizzlies, most recessions are relatively mild in nature:

There’s a lot on that chart, here’s what you’re looking for:

- Vertical gray bars are official recessions

- Our two most recent recessions are #11 and #12

- Most prior to #11/#12 were comparatively mild

- This current bout is #13

But what’s especially unique about this one is that we intentionally induced this recession. Just 2 months ago, the economy was firing on all cylinders with no real serious headwinds. I continually called it the ‘Goldilocks’ economy – not too hot, not too cold; it was just right. Then a nasty virus came along, and we intentionally, almost overnight, shut down the economy – on purpose. I’m not sure we’ve ever done that before.

So, if we have a saving grace in all of this, it’s that we were on such strong economic footing to start.

Recessions become self-fulfilling prophecies. Think about that for a minute. If you think your income is going to go down in the future, what do you do? You sit on your hands and hoard your cash in anticipation. And as we’ve also discussed before, one man’s spending is another man’s income. When you reduce your spending, you reduce another man’s income, which reduces his spending, which reduces another man’s income, and so on. Recessions start in our heads, but manifest themselves in our wallets.

So, what can we all do to help with the economic recovery?

We’ve all chipped in tremendously to blunt the health impact of this virus spread. We social distanced; we locked-down; we stopped traveling; we stopped school, work, leisure and a million other of life’s routines.

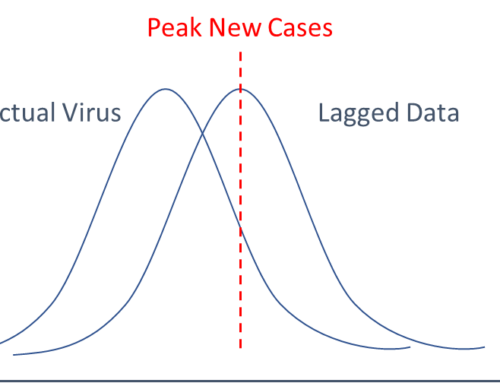

And it’s looking like we’ll soon be able to emerge from these lockdowns and restrictions – the doctor is going to start cutting the casts off. We’ll need to quickly start ‘exercising’ our economic muscles to stave off the atrophy of the last couple weeks.

How? Intelligent spending. I’m not saying to go out and spend out of control. But once you’ve set some aside, and have a solid, long-term plan in place, go out and live your life (economically anyway) as you did before. You’ve earned it, now go enjoy it. Responsibly.

You spending money on another’s goods and services provides income for them to purchase another’s good and services, which produces the income that eventually comes back to purchase your goods and services. A rising tide lifts all boats. One man’s spending is another man’s income.

A V-shaped or U-shaped or L-shaped recovery will largely depend on how each of us responds when the cast comes off.

Let’s pull a Canada on this one; don’t let a recession become a self-fulfilling prophecy.