Whoa! What just happened?

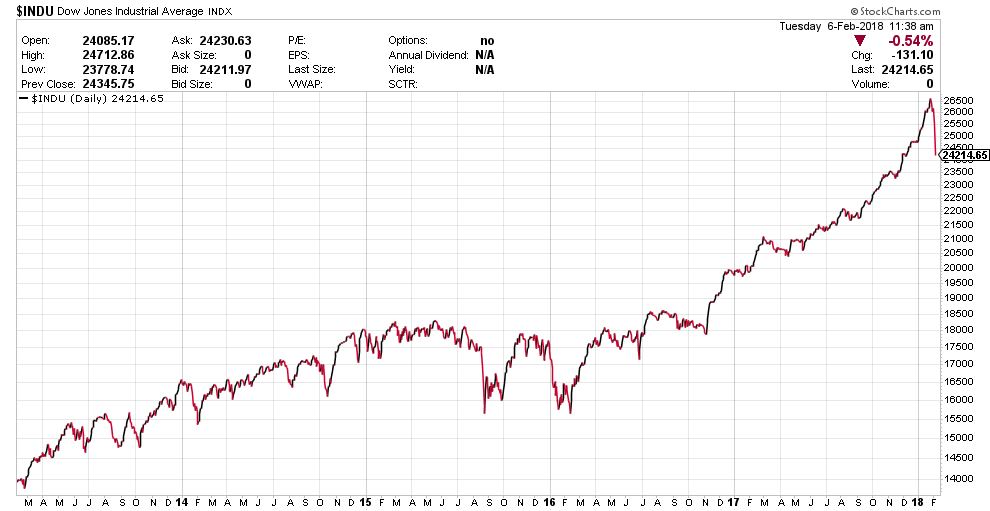

After putting up a 46% run since November 2016, the Dow Jones Industrial Average has retreated 8%, most of that over just the last couple days:

Why? What’s going on?

The academic reason:

- Central banks have kept interest rates artificially low for several years to stimulate the economy

- The economy is doing very, very well right now and signs of inflation are FINALLY starting to show up in the data

- This pressures the Fed to continue hiking interest rates to slow the mounting inflation

- In the short-run, rising interest rates hurt bond prices, real estate prices, and to a lesser degree, stock prices

The humanistic reason:

- Markets are made up of millions of individual human investors

- Humans are human; we use logic for our long-term plans, but our short-term decisions are fueled by emotion, fear, and greed

- Markets have been on a long run; many investors have been anticipating a correction, but didn’t want to be the ones sitting on the sidelines during the run-up

- Once one person started for the exits, the herd followed suit not wanting to be the last one out the door

So what does this mean?

Not much, really. It means markets are behaving normally:

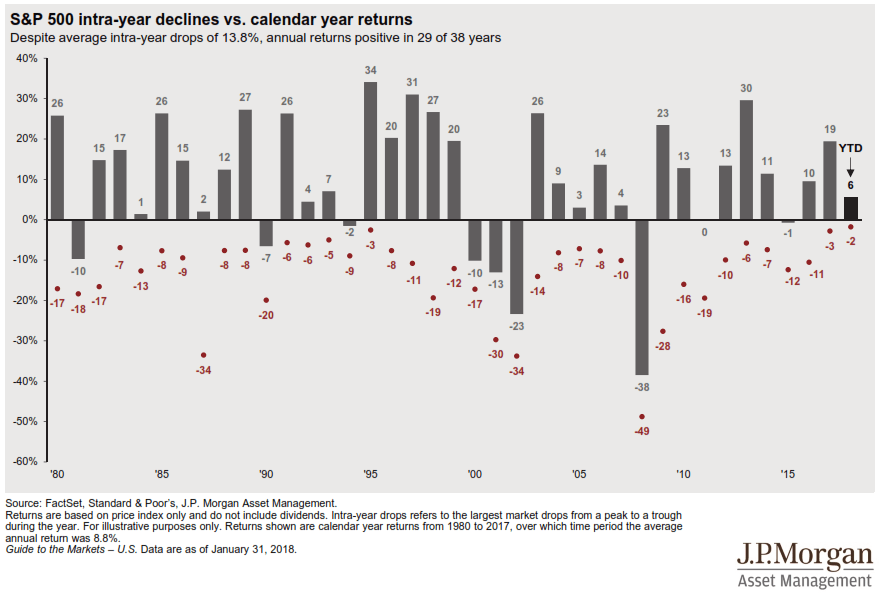

The chart above shows year-by-year returns for the last 38 years. The grey bars show where the year ended, but the red dots show where – at one point during the year – the market was down the most. For example, look at 2010: at one point during the year, the market was -16% (the so-called ‘intra-year decline’), but finished the year +13%. Looking at the last 38 years collectively, the average intra-year decline is -13.8%; so far for 2018, we’re about -1.89%. We have a long way to go before we even become a ‘normal’ year. The most interesting part is that despite the average intra-year drop of -13.8%, year-end returns ended up positive 29 of the 38 years. Markets are resilient.

Not much has changed in the economy in the last couple days. But investors have spooked each other into thinking so. Just remember, for every person selling, someone else is buying. Half the market thinks 24,500 on the Dow is a great price to sell. Half the market thinks it’s a great time to buy. If you’re thinking it’s a good time to sell, what do those buying know that you don’t? If you thought stocks were great just two weeks ago at 26,000, they must look even better now at 24,500.

So, what are we going to do about it?

This is the very reason behind our momentum strategy. We’ve been saying for a while now (as have many others) that markets were a bit frothy and getting closer to a needed correction. It was the timing we were unsure of.

We implemented our momentum strategy to place a mathematical floor under our investment positions where we could trigger out of a position at a certain level. Many of those levels have been breached over the last several days and we have sold out of our long-dated bonds, high-yield bonds, mortgage backed securities, and equity real estate in order to preserve investor capital. The proceeds from those sales are currently parked in a conservative, high-quality bond fund until the storm passes. You will see this activity reflected on your January and February account statements.

We are still invested in US stock, international stock, and emerging market stock. Despite the last couple days, we will continue to hold those equity positions unless conditions deteriorate further.

We’re actually fairly optimistic about the future. The recent tax-cut package is a boon to the US economy as it has now become cheaper to do business in the US. Corporate profits are at record highs; the S&P 500 Index also set new record highs on 14 different days in January, the most since June 1955. The future is bright, but a little shake-out is probably about due.

Markets move up, markets move down. In the short-run, markets are very unpredictable. In the long-run, markets are very predictable.