Next Friday, June 21, we’ll celebrate the Summer Solstice. For us in the Northern Hemisphere, this solstice marks the longest day of the year – approximately 15 hours and 15 minutes of sunlight here at the 42nd parallel north. Early dawns. Long days. Late sunsets. Short nights. My favorite time of the year.

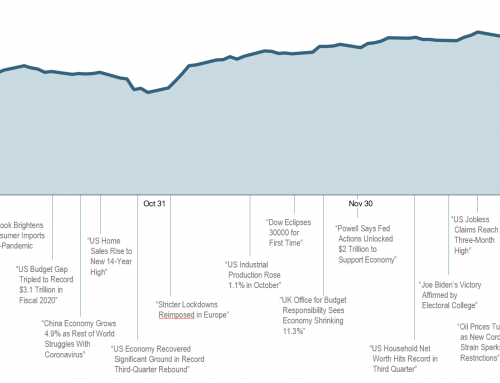

And 10 days later on July 1, we’ll celebrate another hallmark: the current US economic expansion will turn 120 months old, surpassing the March 1991 – March 2001 expansion and becoming the longest US economic expansion on record.

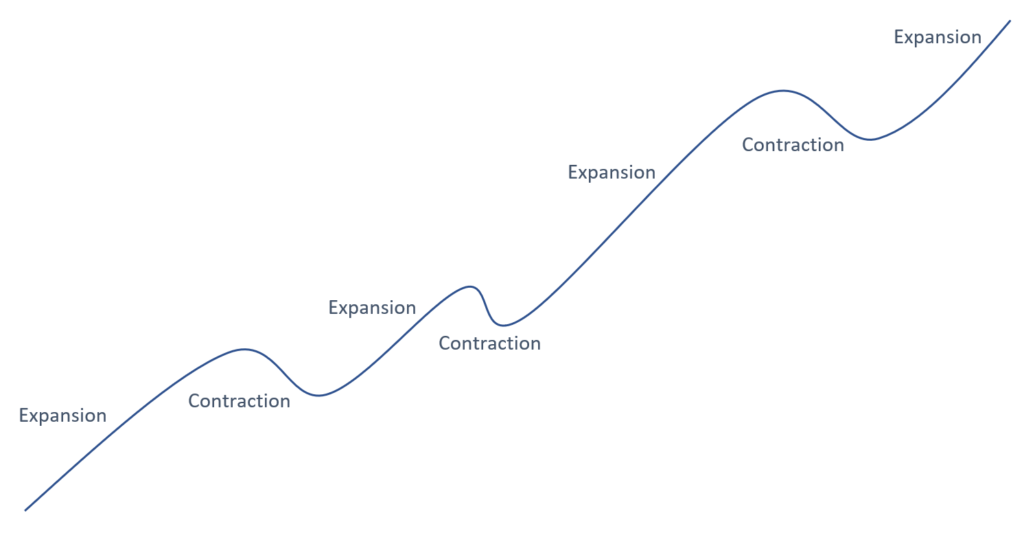

Our economy expands and contracts in a cyclical fashion similar to summer and winter. But unlike the very predictable timing of our weather seasons, our economy expands and contracts on a very irregular cycle:

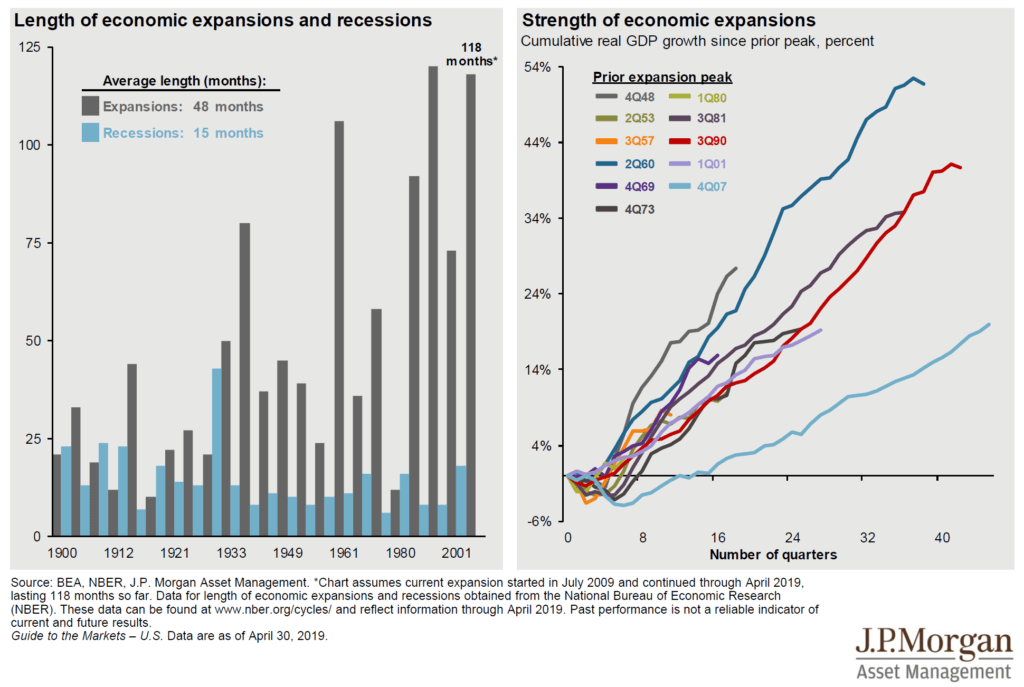

That’s the theory, here’s the empirical data:

The chart above left shows the length of the last several expansions in gray bars and the length of the corresponding contractions in blue bars. Historically, the average expansion lasts 48 months before the economy goes through a period of contraction/recession. The average is 48 – we’re currently at 120.

But just because this current expansion is getting long in the tooth does not mean it cannot run for a while longer. There is no mysterious economic law that says expansions must end at 10 years. Our Dutch friends went 27 years without a recession, Australia’s current expansion will turn 28 years old here in a couple months, and Japan ran 32 years without a recession. Comparatively, we’re still minor-leaguers.

Furthermore, there’s been a distinct change in US expansions since 1990. Prior to this, the Federal Reserve did not specifically target inflation – they let it run at whatever it came in at. However, starting in the early 90’s, the Fed began targeting inflation, explicitly stating they would manage the economy around a ‘dual mandate’ of 2% inflation and 5% unemployment (which tend to run counter to each other).

Since the Fed made this change, our expansions have looked dramatically different. Since 1990, our average expansion has lasted about 102 months. Maybe our current 120 month expansion isn’t all that out of line.

Now, to be sure, this current expansion is very mature. Growth is slowing, labor markets are tight, and inflation is picking up – all classic late-cycle indicators.

But long story short, we’re getting better and better at managing the cyclical nature of our economic and business cycles. Our expansions are longer and longer, and our contractions/recessions are shorter and shorter. Said otherwise, our summers are becoming longer and longer, and our winters are becoming shorter and shorter.

Not a bad place to be.