Greetings on this Wednesday-before-a-long-holiday-weekend.

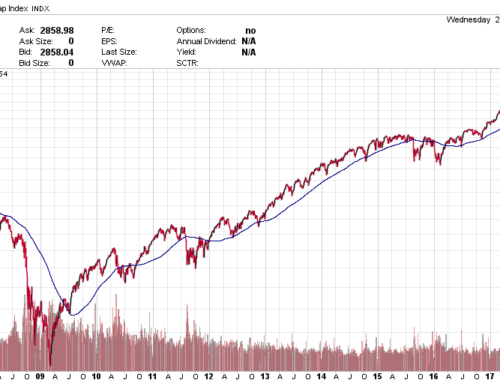

Stock, bond, and real estate markets have been under a lot of selling pressure over the last several weeks. So much so that the NASDAQ is now officially in ‘correction’ territory (roughly defined as being down 10% from recent highs), though after putting up a strong run earlier in the year, is essentially flat for the year. To put this in perspective, the NASDAQ ended last year at 6,903. As of yesterday, it was at 6,908.

So, just how can markets be flat or slightly down when all we hear about is how strong the underlying economy is? The given reasons are varied:

- The Fed is raising interest rates to slow the economy

- Increasing global trade disputes have people cautious about the future

- The global expansion is long-in-the-tooth and running out of steam

The reality is that it’s likely a combination of all the above, plus more. No one knows where markets will be 6 months from now; anyone telling you otherwise is just guessing.

But to explain the mechanics of why interest rates going up causes bonds to go down, I recorded a short whiteboard video:

(click image below to play)

And a second on what happens to stocks when interest rates go up:

(click on the image above to play video)I’ll start putting these out occasionally. Let me know if there are specific topics you’d like me to tackle.And as you settle into your Thanksgiving break, take a moment and reflect on what all you do have. Spend some time with family and friends and recognize the peace and prosperity we enjoy in this corner of the world relative to many other parts of our global community.Have a happy Thanksgiving and safe travels to all those on the road this weekend —

(click on the image above to play video)